Auto Loans

No speed bumps, no detours, no hassles. No kidding.

It's the fast track to financing a new or used vehicle loan. Our low interest rates and flexible payment schedules put us miles ahead of the competition.

Auto Loan Details

When you choose to finance your vehicle with us, you'll hit the road faster than ever before!

Benefits of an Auto Loan with EFFCU:

- Great Rates & Flexible Terms

- Refinance & Save: Lower your interest rate and monthly payment by refinancing your current loan.

- Insurance Made Easy: Get auto insurance through our trusted partners—all in one place.

- Add optional coverage for more peace of mind.

- Apply in minutes and get pre-approved fast.

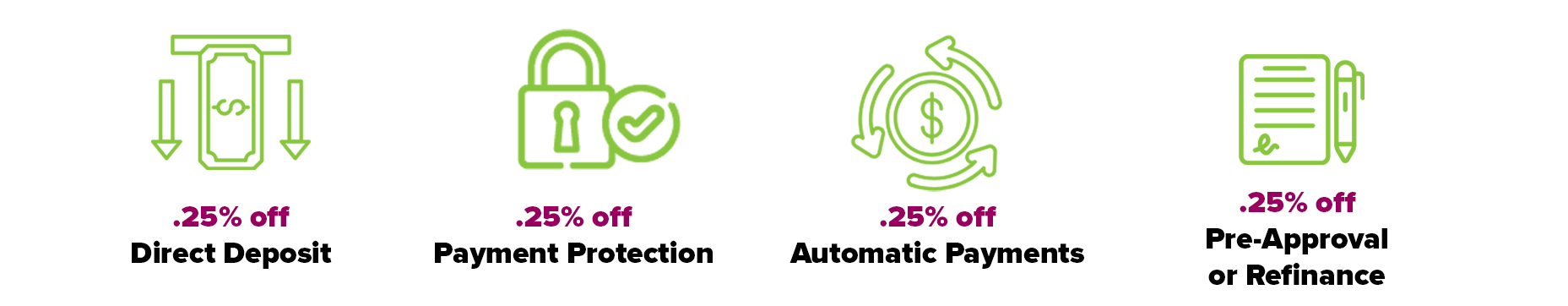

- Up to 1% off your rate*

Save up to 1% on your auto loan when you set up the following:

That's right, Education First FCU members are eligible for up to a 1% discount on their car or truck loan by signing up for direct deposit, automatic payments, and vehicle payment protection. Just another perk of being an EFFCU member!

New and Used Vehicle Loan Rates

| Terms | APR* |

|---|---|

| 36 Months | 3.25% |

| 48 Months | 3.50% |

| 60 Months | 3.75% |

| 72 Months | 4.25% |

| 78 Months | 4.50% |

| 84 Months | 5.00% |

Optional Protection Plans

Now that you have a great vehicle, get some peace of mind as well. Breakdowns, accidents and illnesses happen, so it's best to be prepared. Protect your finances and your vehicle with our protection products.

- Guaranteed Asset Protection (GAP) covers the difference between your auto insurance settlement and your auto loan balance in the event that your car is stolen or damaged beyond repair.

- Mechanical Breakdown Protection provides coverage that serves as an extended warranty.

- Credit Life and Credit Disability policies will pay off your vehicle loan in the event something happens to you.

- Depreciation Protection Waiver. DPW, or Total Loss Protection, waives some or all of your auto loan balance in the event of the total loss of your vehicle.

CARFAX® Report

Education First provides a CARFAX Vehicle History Report™ to help protect our members from salvage, total loss, structural damage, lemon and flood vehicles. Use the form to request your free CARFAX Report, and a member of our team will follow up with you.

Want to know what a CARFAX Vehicle History Report™ includes? Click the button below for detailed information.

*CARFAX Vehicle History Reports are based on information supplied to CARFAX. CARFAX does not have the complete history of every vehicle. **Subject to the terms and conditions on Carfax.com

Auto Loan Calculator

Use Education First Federal Credit Union's Auto Loan Calculator to find out how much you need to budget for your ride.

Access Now

AutoSMART

AutoSMART is a one-stop shop for stress-free car shopping, comparing prices from various dealers, and even applying for financing.

Dash!

Dash! is an online payment platform that makes paying your Education First FCU loan from an external account quick and easy.

Insurance

Why leave the future to chance? Our comprehensive insurance solutions can secure a bright and assured tomorrow for you and your family.

BUYING - AND KEEPING - A CAR

In this guide, you'll learn about how to shop for a car and what to consider when making a purchase. You'll also find tips on how to maintain and care for your car, as well as how to save money on gas and insurance.

Download NowAuto Loan FAQs

All rates and terms are subject to change without notice. Loan rates are subject to credit approval and based on individual creditworthiness, amount financed, loan term and vehicle characteristics. Your Annual Percentage Rate (APR) will be based on your specific situation. View our auto loan rates here

No, our rates are the same for both new- or used-car purchases. View our interest rates here

Your monthly payment is determined by several factors, including your loan amount, term, and interest rate. Utilize our Calculate a Vehicle Payment calculator to get you started.

Handy Tools at Your Disposal.

Calculate your budget, see and compare the latest rates and discover what perks you gain for being a member of Education First Federal Credit Union.

Calculate the best auto loan amount that fits your budget.

Check current rates and find out which ones adhere to your loan type.

When you want a better place to hold your accounts and grow your money, Education First is at the head of the class.