iThrive

Get Ready to Feel Good.

Ready to get your finances on track? iThrive is all about the big picture. Track your spending by category. Set a savings goal. Create a budget and stick to it. Invest a few minutes of your time on set-up and you'll reap big rewards.

Get Started TodayManage Your Finances with iThrive.

Located within Online Banking, iThrive allows you to track your cash flow and spending by category. Set up savings goals, manage your budget and more! Click on the expandable boxes below for detailed information and instructional slide-decks. iThrive - now there's nothing holding you back.

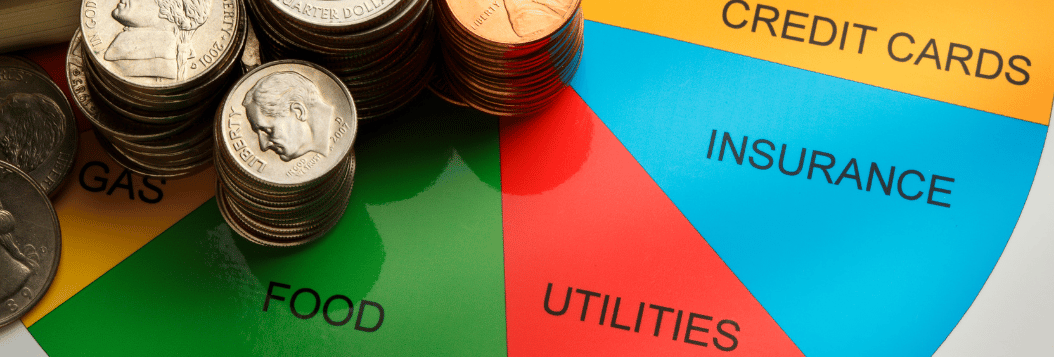

View your top expenses in real-time with the Spending by Category Interactive Spinning Wheel. Tag your transactions to see where and how you spend your money. View your transactions from each category to stay in touch with your spending and overall finances. Check back soon for a detailed tutorial on Target Spending.

It’s easy to create a customized budget. iThrive’s budget tools will help you monitor and track your spending. Budget insights provide your spending history, along with suggestions for staying on track. Check back soon for a detailed tutorial on how to set up a budget.

The cash flow calendar brings your budget to life through an interactive calendar. By adding your paycheck and other sources of income along with your expenses, you’re now able to view income and spending trends right from the calendar. The better you understand your cash flow, the easier it is to manage it on a daily, weekly, and monthly basis. Check back soon for a detailed tutorial on how to set up cashflow functionality.

Combine your Education First accounts with external accounts for a complete financial picture. iThrive incorporates data from thousands of financial institutions, credit card providers, investment firms and more. View transactions within each account that can be tagged for budgeting. Linking those accounts is quick and easy. Check back soon for a detailed tutorial on how to link external accounts.

Create savings goals, like saving for a vacation, or a debt reduction goal, like paying off a high-rate credit card. Visually tracking your progress allows you to reach your financial goals quickly and easily. Create your own deadlines and iThrive tracks your progress automatically. Check back soon for a detailed tutorial on setting up goals.

Receive email or text alerts to notify you when you have an upcoming bill, exceed a spending target, or when you have reached a financial goal. Check back soon for a detailed tutorial on how to set-up alerts.

Track your investments, wealth and debts all in one place to get a snapshot of your net worth. Your financial future is just as important as your day-to-day. Check back soon for a detailed tutorial on how to set up your Net Worth.

Handy Tools at Your Disposal.

Calculate your budget, see and compare the latest rates and discover what perks you gain for being a member of Education First Federal Credit Union.

Calculate the best loan amount that fits your budget.

Check current rates and find out which ones adhere to your loan type.

When you want a better place to hold your accounts and grow your money, Education First is at the head of the class.