Buy Now, Pay Later

Flex your budget. Pay your way.

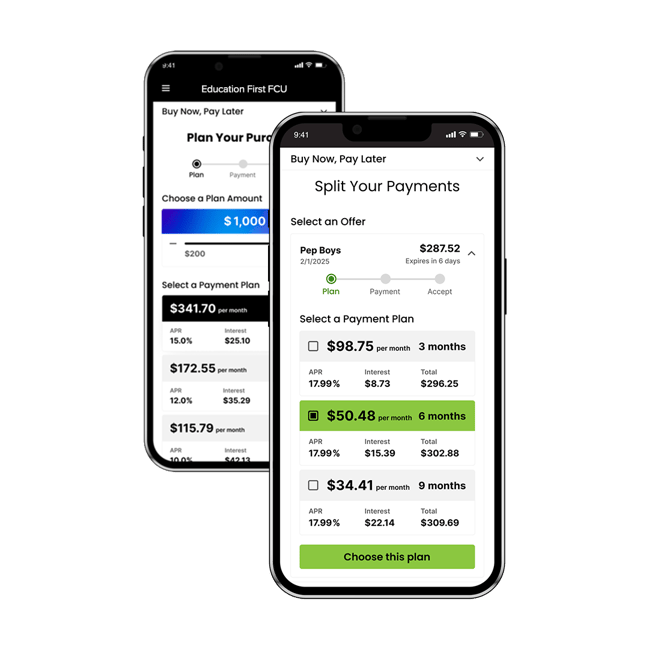

Now LIVE! We're excited to announce Buy Now, Pay Later: A feature from Education First FCU that offers two types of services available to eligible members with a checking account. Whether you are planning a purchase or looking to spread out payments for one you’ve already made, Buy Now, Pay Later can help manage your cash flow and stay within your budget.

- Plan Your Purchase offers are for qualified members with Checking Accounts who need funds upfront to make a purchase and would like to pay for the loan in installments over time.

- Split Your Payments offers are available to qualified members who have already made eligible debit card purchases and would like to pay for those purchases in installments over time.

- Questions? View our complete BNPL overview guide here.

Convenience for YOU:

- No credit check.

- No application. Your BNPL offers are tailored for you if you are pre-qualified. Simply view and accept to proceed.

- No new cards and accounts. Continue using your existing Education First FCU checking account and debit card when accessing offers.

- It's all located in Online Banking. Review and manage your BNPL offers, plans, and payments in one place.

Buy Now Pay Later Additional Guides

Frequently Asked Questions

BNPL offers are found in Education First Federal Credit Union’s Digital Banking from the "Buy Now, Pay Later" tab. Offers will also be emailed directly to you.

There is no application for an Education First Federal Credit Union BNPL loan. All Split Your Payment and Plan Your Purchase BNPL offers found within your Online Banking are pre-qualified for you to view and accept. You will receive a copy of the loan agreement in your email.

BNPL can be used for both online and in-store purchases. This includes purchases like new clothes, school supplies, travel, and technology upgrades. It can also be used for unexpected and often under-budgeted expenses such as medical, dental, and vet bills!

BNPL offers will not be sent for items like loan payments (mortgage, auto, credit card, etc), cash transactions such as ATM withdrawals, lotteries, and more.

After you have accepted an Education First FCU BNPL offer, your purchase amount will be deposited into your account in moments. In some cases, it can take up to 24 hours.

No, Education First FCU’s BNPL offering does not require a credit check.

If you do not see any BNPL offers, this may be because your current account status is not eligible for BNPL. If you already have active BNPL plans, you may not be eligible for additional offers until the active plans are paid back.

If you are eligible for Plan Your Purchase but do not see Split Your Payment offers, this may be because your recent debit card purchases are not eligible for BNPL.

Yes. You can pay off your BNPL plans early within your Education First FCU Online Banking, at a branch, or by calling our contact center at (409) 898-3770!

A purchase eligible for Split Your Payments is a debit card purchase made in the past 60 days that is at least $80 and was not a cash equivalent purchase (e.g., ATM withdrawal, money order, cash advance, etc.). Other restrictions surrounding the merchant type and transaction limits may affect BNPL eligibility.

Yes. Your eligibility for BNPL offers is partly determined by the number of outstanding loans you have active. Therefore, taking out Plan Your Purchase loans may impact how many Split Your Payments offers they are eligible for, and vice versa.

Yes, this loan will be reported to the credit bureaus as a new open account, and the payment history will be reported monthly, which can affect your score either negatively or positively, depending on the history.