How can we help you today?

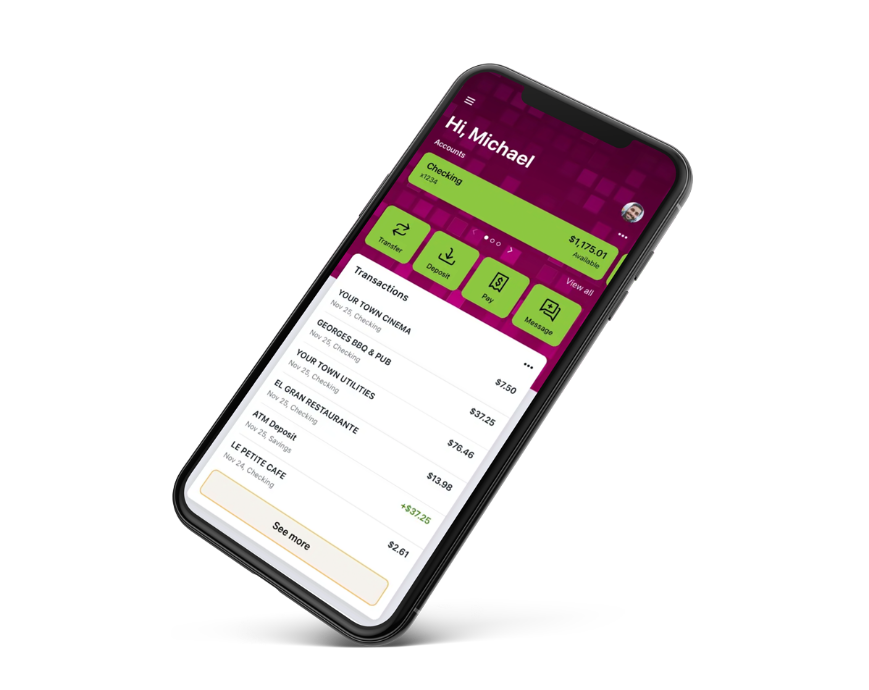

Customized Checking Accounts that fit your needs.

Our expert lending team is ready to help. Explore your home lending options now and make the process a breeze!

Be on your way to your next new ride with flexible repayment plans, and no payments for 90 days.

Hear what members have to say.

"Love the energy of EVERY employee. I'm immediately happy upon entering. Never had an issue that wasn't solved in a timely manner and little to no wait times."

"Victoria at the Lumberton EFFCU just made my day. Our church had someone donate a huge jar of coins, and I was facing hours counting it all and dealing with it. She helped me take care of it quickly despite the atypical ask, all with a lovely smile and polite, professional service that tells you she is one of those folks who is beautiful inside and out. EFFCU has a gem, and continues to be our financial center of choice."

-- Craig C., February 2026"I bank here also! I’ve always used their services, gotten my last car loan here and was extremely pleased with my total loan transaction!"

-- Laura C., December 2025"I always receive exceptional services. I am treated like family and always greeted. They are always willing to help with everything!"

-- Shannon S., October 2024"I have been a loyal customer since the 1970s. The name has changed and they have opened new locations, but that's growth. I love the friendly and fast service. If I call or come in, communication is always helpful. I love the way different branches assist and are team players and problem solvers."

-- Mary Saveat, October 2023Find a Branch or ATM Near You

Find the nearest Education First branch or ATM to your current location. Search for branches and ATMs by city, state, or zip code, and provides you with the location, address, and hours of operation for each location.

Sun’s Out, Budgets Intact: A Guide to Spring Break in Southeast Texas

Spring Break is right around the corner, and here in Southeast Texas, that means it’s time to swap busy schedules and unpredictable weather for sunshine, relaxation, and a well-deserved reset. ☀️

5 Ways We're Helping You Kick Off the New Year with Financial Confidence

New year, new…. Fine, we won’t say the cliché. 😉 However, with the new year ringing in, now’s a good time to do a financial check-in. And here’s where we come in – reminding you to make this year a good one!

Learn More

10 Credit Union Membership Perks

Celebrate ICU Day with Education First FCU and explore 10 perks that make membership more rewarding!

Learn More