How can we help you today?

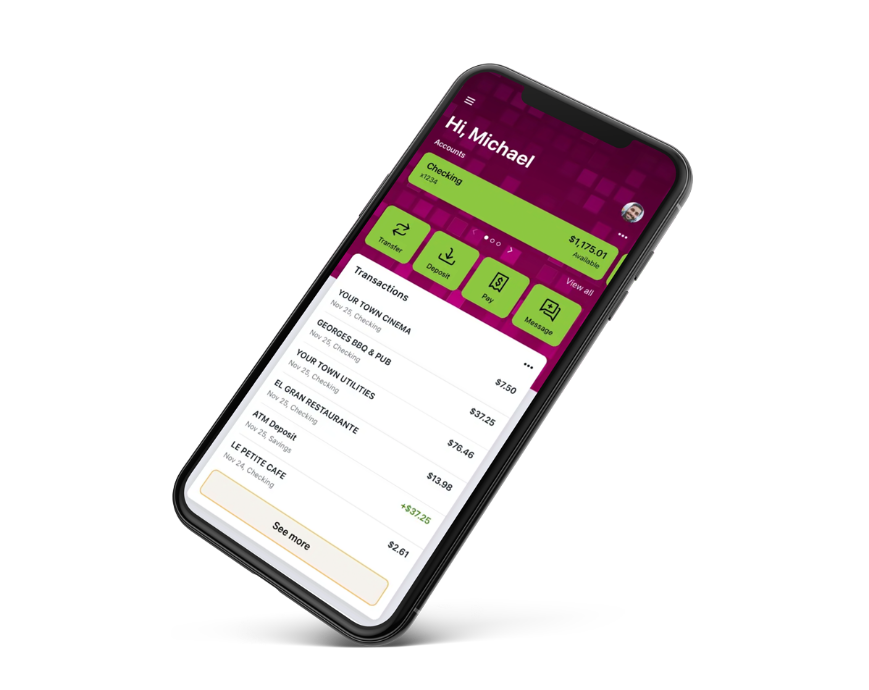

Customized Checking Accounts that fit your needs.

Our expert lending team is ready to help. Explore your home lending options now and make the process a breeze!

Be on your way to your next new ride with flexible repayment plans, and no payments for 90 days.

Hear what members have to say.

"I love education first, they are professional, fast, and efficient. From the door to the front desk, they greet you with smiles and welcome you in. If you aren't banking with them, then what are you doing?! Great bank and great people!"

"Always available to assist with my banking needs. I always feel like family and not just a member. The service is like at Chick Fil A, always pleasant and with a smile."

-- Amanda Magdaleno, October 2023"You know professionalism and good customer service is at its peak when you have three generations of one family that banks there. Education First FCU embodies high standards."

-- Sandra Levine, October 2023"I have been a member of this financial institution for over 30 years. They have always been helpful and kind. Through the years, they have provided many services and products that have blessed our family! I am thankful for this longstanding relationship."

-- Kevin Wharton, October 2023"I have been a loyal customer since the 1970s. The name has changed and they have opened new locations, but that's growth. I love the friendly and fast service. If I call or come in, communication is always helpful. I love the way different branches assist and are team players and problem solvers."

-- Mary Saveat, October 2023Find a Branch or ATM Near You

Find the nearest Education First branch or ATM to your current location. Search for branches and ATMs by city, state, or zip code, and provides you with the location, address, and hours of operation for each location.

Dealer Add-Ons to Avoid When Buying a New Auto

Buying a new car is more expensive than it's ever been. So the last thing you need is to pay for a bunch of dealer add-ons that you don't need.

Learn More

Budgeting 101: Your Guide to Financial Freedom

Want to keep your finances on track? Following a budget is the first step. We'll teach you how to create one. Don't let the fear of not knowing where to start keep you from creating a budget that will keep your finances on track.

Learn More

How to Create a Monthly Budget That You'll Stick to

It's no secret that a budget is the key to eliminating financial stress and reaching your financial goals. So why do so many of us fall short?

Learn More